SBA Site Visits

- Assists lenders who offer government-guaranteed lending in assessing the size, viability and legitimacy of business lending applicants.

- Provides On-Site Verification of applicant’s physical location and business operation.

- Satisfies the site visit requirement of SBA as part of Its 7(a) lending program.

- Conducts professional observations and photographic reinforcement provided by vetted, well-trained inspectors.

- Substantiates representations made on SBA lending application.

- Performs intuitive, industry-specific quality review process.

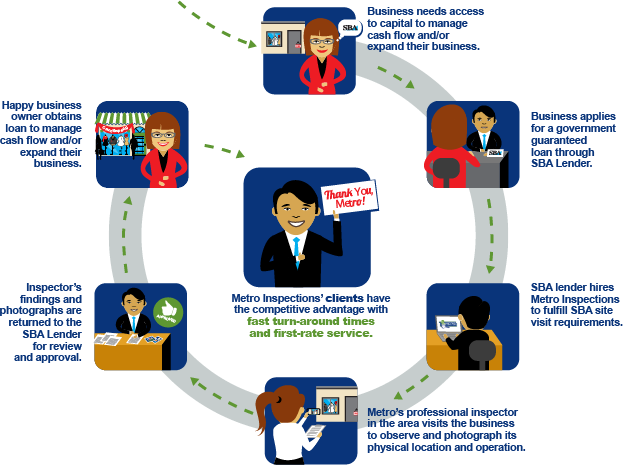

The SBA guarantees business loans to businesses based on specific aspects of the business and its principals. Some of the key factors of eligibility are based on what the business does to receive its income, the character of its ownership and where the business operates.

To satisfy the SBA requirements, institutions who offer government-guaranteed lending are required to verify applicants’ operations, locations and type of business. The fastest, most effective and thorough way to for them to obtain such verification is to hire Metro Inspections, an unbiased, third-party inspection provider with an understanding of the industry specific concerns

We know that each of our clients, while being in the same or similar industries, have very unique attributes, policies and preferences. For this reason, we realize that one size does not fit all. Each new client Metro Inspections takes on goes through an on-boarding process, which includes preference meetings (on-site or via tele-conference) designed to customize each and every step of the inspection process. Just a few popular customizations include:

- Ordering Method (i.e. click-to-order, manualentry, email, API)

- Scheduled Appointments vs. Unannounced Inspection Visits

- Required Photos

- Inspection Questions

- Scripts for Contacting Merchant

- Preferred Communication Methods

- Reporting

- Billing

This level of customization creates as seamless experience as possible for the payments provider, freeing up time and attention to focus on other priorities rather than micromanaging their inspection vendor.

Given the demanding schedule of the risk management and credit professionals who rely on our services, we understand the necessity for quick, constant, efficient communication. A key element of Metro Inspections’ business model is responsiveness. Any client communications, whether they be general in nature or specific to an inspection order, are addressed immediately and a resolution communicated promptly upon its finding.

Our Clients have direct access to our Inspection Coordinator team via telephone, email and online messaging for instances regarding specific inspection orders. In addition, a Relationship Manager is assigned at Metro Inspections to work directly with a specific designee to ensure that all preferences are kept up-to-date as well as to resolve any issues or concerns that may arise regarding the terms of the partnership. In addition, Metro Inspections’ Relationship Managers are issue-resolution experts. As such, they are included in all communication regarding any escalated situations, and, in many cases, will get involved to ensure a speedy resolution of the issue.

Please contact us at

623-930-0466

today to get started!